In today’s digital age, the convenience and flexibility offered by financial tools are transformative. Among such tools, virtual EMI cards have emerged as a popular choice for individuals looking to simplify payments for online shopping and travel. These virtual cards are designed to offer instant access to credit on purchases while allowing repayment in easy installments. With increasing digital adoption, more consumers in countries like India are leveraging these cards to manage their finances smartly and effectively. In this article, we will dive into thetop benefits of virtual EMI cards while exploring their utility for online shopping and travel.

1.Ease of Access and Instant Approval

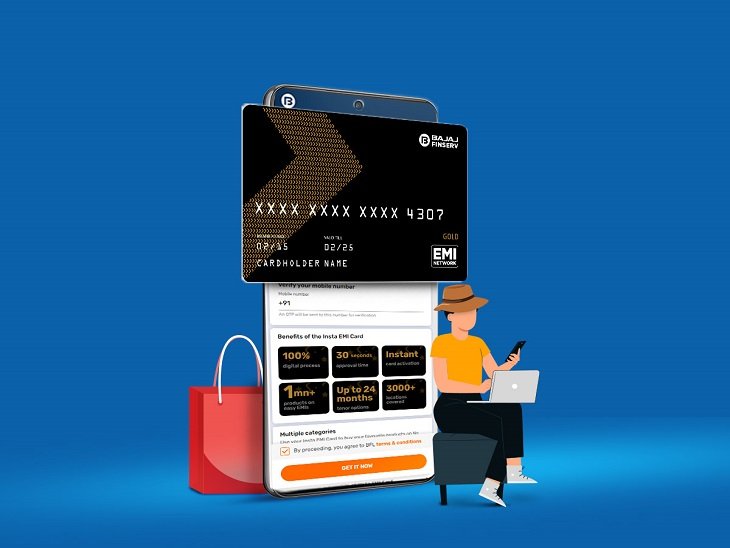

One of the standoutbenefits of virtual EMI cards is the ease with which they can be accessed. Unlike conventional credit cards, these cards are typically digital, which means you don’t have to deal with lengthy paperwork or wait for physical cards to arrive. Whenever you need credit, you can apply for a virtual EMI card online and receive instant approval, provided you meet the eligibility criteria.

In markets with dynamic sales trends, especially insales-driven regions like India, this instant accessibility proves advantageous. Consumers can quickly avail themselves of credit to seize limited-time discounts during festive sales or mega promotions. The seamless application and activation process make virtual EMI cards ideal for users looking for swift financing options.

2.Flexible Payment Plans56_1660031349 (1)

Another primary reason why individuals opt for virtual EMI cards is the flexibility they offer in repayment. Unlike traditional payment methods where expenses need to be settled in one go, virtual EMI cards split your payments into manageable installments. Whether you’re splurging on high-ticket electronics duringonline sales in India or planning a luxury vacation to an exotic destination, virtual EMI cards spread your financial burden across several months.

For online shoppers, it means purchasing expensive gadgets, furniture, or lifestyle products without the stress of upfront payments. For travelers, it means booking flights, accommodations, and tours without depleting their savings. The flexibility to repay in small amounts over time reduces financial strain and makes big-ticket purchases more accessible.

3.Enhanced Financial Management

Managing personal finances can be challenging, especially with rising inflation and growing expenses surrounding travel and shopping. Virtual EMI cards offer a practical solution by enabling users to plan their expenses better. Since the repayment schedule is predefined and divided into fixed installments, users can budget their monthly expenditures with confidence.

Such structured payments are particularly useful insales-driven economies like India, where cyclic offers on electronics, home appliances, and travel packages can tempt overspending. Virtual EMI cards encourage responsible purchasing while ensuring that users stay within their financial limits. Additionally, most virtual cards come equipped with reminders or notifications so that users are aware of their upcoming dues and can avoid late fees.

4.Digital Nature and Convenience

The digital-first approach of virtual EMI cards sets them apart from traditional financial instruments. Everything, from application and transactions to repayment, happens online. This offers unparalleled convenience, especially for tech-savvy individuals who regularly shop online. Virtual EMI cards eliminate the need to carry physical cards, making them ideal for e-commerce transactions.

In scenarios where travel is involved, virtual EMI cards shine because of their usability across digital platforms. Whether booking flights, reserving hotels, or purchasing travel insurance online, virtual EMI cards simplify the process without compromising security. Their integration with online platforms ensures smooth payments, granting travelers peace of mind.

5.Affordable and Transparent Costs

For those wary of hidden charges, virtual EMI cards are a breath of fresh air. These cards are designed with affordability and transparency in mind. Typically, users are presented with clear repayment schedules, interest rates (if applicable), and associated fees upfront, ensuring they know exactly what they are signing up for. Many virtual EMI cards offer zero or low-interest options on select purchases, making them a cost-efficient choice.

Duringsales events in India, where consumers often seek the best deals on gadgets, clothing, or travel experiences, the affordability of virtual EMI cards amplifies their appeal. Shoppers can enjoy interest-free periods or minimal costs while paying in installments, making expensive products more accessible without compromising their financial stability.

6.Travel-Friendly Features

Traveling often requires upfront expenses, whether it’s booking tickets, accommodations, or paying for experiences. Virtual EMI cards offer travelers the opportunity to finance these expenses affordably while minimizing immediate out-of-pocket costs. Travelers can plan trips confidently, knowing that payments are split over months.

Additionally, many virtual EMI cards include travel-specific benefits such as cashback, rewards, or special discounts on bookings. These perks allow frequent travelers to maximize their benefits while sticking to budgets. For example, during seasonal holidays or long breaks when flight tickets and accommodations see a price surge, travelers can leverage virtual EMI cards to maintain affordability.

7.Encourages Responsible Spending

Unlike conventional credit cards that come with large credit limits, virtual EMI cards encourage responsible spending by providing calculated limits based on usage and repayment capacity. This ensures that users do not overspend and remain disciplined with their financial commitments.

Insales-oriented markets like India, this feature proves useful as customers often shop impulsively during festive deals and promotional events. Virtual EMI cards bring structure to their expenditure by setting repayment terms upfront, which helps minimize the risk of excessive spending and debt accumulation.

8.Secure Transactions

Safety and security are critical concerns in online shopping and travel bookings. Virtual EMI cards address these concerns through their secure, digital nature. Since these cards are accessed and stored online, there’s no risk of losing a physical copy. In most cases, virtual EMI cards offer additional layers of security, such as OTP authentication or encrypted transactions, making them ideal for hassle-free digital payments.

For consumers utilizing online platforms duringsales in India, the assurance of secure transactions adds confidence, especially when dealing with significant purchases. It eliminates the fear of identity theft or unauthorized access to financial details, ensuring a seamless shopping experience.

Conclusion

Virtual EMI cards are redefining how consumers approach payments for online shopping and travel-related expenses. Their ability to offerflexible payment plans, ease of access, affordability, and security makes them an indispensable tool for modern-day financial management. Whether you’re grabbing deals duringsales events in India or financing an unforgettable vacation, these cards empower you to make big-ticket purchases without immediate financial strain.

By embracing virtual EMI cards, consumers can enjoy convenience, better budgeting, and enhanced security—all while leveraging the flexibility that these digital tools bring to the table. It’s time to make smarter financial decisions and embrace the future of digital payments.